The House pushes for final passage

Republicans appear to be on the cusp of final passage of the “Big, Beautiful Bill.”

Photo credit: Wikimedia Commons

Blessings on you and your family, and from all the Huckabee Post staff! Thank you again for subscribing!

This week is Fourth of July week, when many Americans, including the Huckabee Post staffers, are taking a break. Don’t worry, we’ve prepared plenty of material in advance for you. And as always, if anything major happens in the news, we’ll drop our corn dogs and rush back to our keyboards to report it (fortunately, World War III breaking out suddenly seems a lot less likely.)

As a reminder the Morning Edition delivers Monday - Saturday.

If you subscribe to the Prayer Tree, it will deliver at 4 PM today.

Daily Bible Verse

But seek first his kingdom and his righteousness, and all these things will be given to you as well.

Matthew 6:33

NEWS BRIEFS

Three news stories we didn’t want you to miss.

1 - The House pushes for final passage

Republicans appear to be on the cusp of final passage of the “Big, Beautiful Bill.” A vote is expected later this morning.

Overnight President Trump was venting his frustration with the process:

As Majority Leader Steve Scalise notes, changes to the bill were never an option, even though some members thought so:

But now the vote is near, and Minority Leader Hakeem Jeffries is using his final minutes to target vulnerable Republicans in swing districts by reading negative letters he’s received about the bill:

2 - A U.S. trade deal with Vietnam

President Trump announced a trade deal with Vietnam yesterday.

https://www.cnn.com/2025/07/02/business/trade-deal-vietnam-trump

He had this to say on Truth Social:

“The Terms are that Vietnam will pay the United States a 20% Tariff on any and all goods sent into our Territory, and a 40% Tariff on any Transshipping. In return, Vietnam will do something that they have never done before, give the United States of America TOTAL ACCESS to their Markets for Trade.”

https://truthsocial.com/@realDonaldTrump/posts/114784170652465525

Commerce Secretary Howard Lutnick echoed this message:

“For the FIRST TIME EVER, Vietnam will open its market to the United States. They will pay 20% to sell their products here, and 40% on transshipping - meaning if another country sells their content through products exported by Vietnam to us (China) - they'll get hit with a 40% tariff. This is HUGE for our farmers.”

https://x.com/howardlutnick/status/1940455257017909375

When you combine the deal with the news that last weekend Canada withdrew its planned digital services tax on American tech companies, you might even say if you were CNN, that President Trump’s tariff strategy can work (at least sometimes in their eyes).

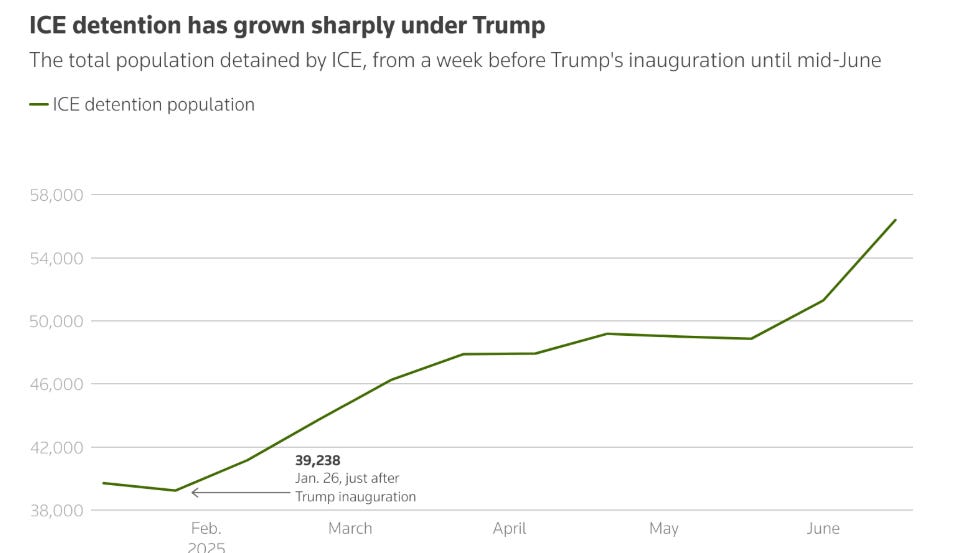

3 - Success at the Border

In June border officials reported zero releases of illegal aliens entering into the country. In addition, Customs and Border Protection only had 25,243 “Nationwide Encounters” throughout the entire month of June.

As President Trump said, these figures are “absolutely STAGGERING, considering the Biden Administration was “encountering” tens of thousands of people every single DAY.”

https://truthsocial.com/@realDonaldTrump/posts/114786058561428668

ICE is stepping up enforcement at historic levels:

https://www.reuters.com/world/us/trumps-early-immigration-enforcement-record-by-numbers-2025-03-04/

Source: Immigration and Customs Enforcement, The White House

NOTE: The Big Beautiful Bill includes $170 billion dollars for border and immigration enforcement. These figures are going to look a lot different soon!

A Fair Tax

The government has to have money to pay for the military, cover the cost of obligations we’ve made like Medicare and Social Security, and build roads, bridges, and airports. We need some things government does, so clearly there has to be a tax process. But the one we have is a detriment to our economy. What if there was a tax plan that was flat, fair, and family-friendly?

There is one. It’s called the Fair Tax, and it would super-charge our economy, but it is terribly misunderstood and opponents say it would raise your taxes. It wouldn’t. It’s pretty simple, really. You wouldn’t be taxed for your work, savings, inheritance, or good business decisions. The Fair Tax would be collected at the point of purchase instead of the point of production.

The current tax system is essentially a penalty on what you produce. We tax your work in the form of an income or payroll tax. And if you work for someone else, your money is taxed before you even get it. It’s taken out of your check before you even cash it. Most people don’t have any idea how much they actually pay in taxes because they never see it. And how nice of you to let the government take your money and use it all year, interest free. The Fair Tax is essentially a sales tax or more broadly a consumption tax. You only pay when you purchase something that is new and hasn’t been taxed before.

Presently we punish productivity and subsidize irresponsibility. If I invest in something that increases in value, which means I made a smart investment, I pay capital gains taxes. But if I invest in something that loses money, I can write that off of my taxes. Get that? Successful investments are punished; failed investments are rewarded. Only the government could create something so absurd!

What makes a strong economy? Work, investments in businesses, savings—even putting aside money to leave for your family to get started with a house or a business. And maybe saving enough to give to charity at one’s death. But we tax all of that. If you spend all your money on stupid stuff or just don’t work, the government will help out with your medical bills and provide a check so you can stay home and play video games. Now here’s a simple principle: If there is a behavior you want more of, reward it; if there is a behavior you want less of, punish it. That’s how we raise children and train dogs. Do the trick and get the treat. But our tax system is the opposite of that. Punish productivity and reward irresponsibility.

The fair tax changes that by letting you keep the money you earn, invest or save. It eliminates the income tax, capital gains tax, and the death tax. You pay taxes when you buy something. And it completely eliminates the IRS. They would be disbanded. Don’t want to pay as much tax? Don’t buy stuff.

But you know who DOESN’T pay income tax, capital gains or inheritance tax like you do? Prostitutes, pimps, drug dealers, and gamblers. They don’t fill out forms in April and tell the government how much they made selling crack to Hunter Biden! So you are paying your taxes AND theirs. But if we paid tax when we purchased things, the prostitutes, pimps, drug dealers and gamblers would pay tax because they still buy stuff. Sometimes lots of stuff that you can’t afford.

The Fair Tax was created by a group of some of the most brilliant economists in the country. They were charged with proposing the fairest and most efficient form of getting the money the government needs without creating a tax code that is so complicated even the IRS doesn’t understand it and you need accountants and lawyers just to comply with it. With the Fair Tax, there are no tax returns. Nothing is taken out of your check. For most of you, for the first time in your life, you’d get your entire paycheck and April 15 would just be another beautiful Spring Day.

Of course, there are a lot of people in government who don’t want the Fair Tax and who lie about what it really is because it takes away their power to manipulate the tax code to reward political donors and punish political enemies. For instance, they claim it would harm the poor and lower middle class when those below a certain income level would get a monthly “prebate” to cover the taxes. The fact is that the system we have now needs to be thrown out and a new plan put in place that’s fair, flat, and family friendly, and that super charges economic growth instead of impeding it.

And did we mention, it eliminates the IRS?

Why We Need Term Limits

You’ve heard the saying, "Two things you should never watch being made -- a law and sausage." The difference is that some people can watch how sausage gets made and still be able to eat afterwards.

For the faint of heart and those without a strong stomach, seeing the process of politics become the process of governing can result in serious reactions. It's not a pretty process. It can be tedious, exasperating, and embarrassing. Look at how Elon Musk melted down when he realized how hard it was going to be to get Congress to cut even shockingly wasteful spending exposed by DOGE.

But let us let you in on a little secret: it’s supposed to be hard to pass laws! You know how many laws we have now? Imagine how many we’d have it were easy!

When they had control of the White House and Congress, some Democrats ranted over what an offense to “our democracy” it was that they couldn’t ram through their agenda with a one-vote majority. They pushed to blow up the system that slows down efforts to enact what they claim “the people” (i.e., “them”) want, from eliminating the Senate filibuster to stacking the Supreme Court with partisan political appointees. They even drove wiser Democrats like Kyrsten Sinema and Joe Manchin out for saying that they’d regret killing the filibuster when they were in the minority. Flash forward to today: The Democrats are in the minority, and suddenly, they love the filibuster again.

This is what John Adams called “the tyranny of the majority.” It’s not only poison to the American system, it’s also a really stupid political tactic. Apparently, Sens. Sinema and Manchin were the only Democrats who understood how dumb it is to strip all power from the minority when you’re just one election and one seat away from being the minority yourself, which had just happened to them in the House in 2022.

As hard as it may be to believe, making a law was never designed by our Founding Fathers to be quick, simple and easy. When they wrote and approved the Constitution, they intended for the passage of a bill into law to be a long, hard slog. They feared that passion would overwhelm reason and thoughtfulness, and so they built in plenty of speed bumps to make sure that a bill never whizzed through Congress and got signed by the President as hurriedly as some celebrities go through rounds of rehab. Some say that was a major reason for creating the Senate: to have a chamber where the actions of the hotheads in the House could cool off. They were described as the cooling saucer that captured the hot spillover from the House coffee cup.

We’re pretty sure that the Founding Fathers didn't want total gridlock in Congress, but as much as it may surprise you, they preferred gridlock to haste. Why? Because they feared government in the same way other people fear snakes, spiders, and sharks. They knew that the sheer power of it is an intoxicant and that most of the people who enter government will be like sixteen-year-old boys with keys to the liquor cabinet whose parents are gone for the weekend. Watching Congress make laws and oversee regulations is a lot like watching sixteen-year-olds with booze and a BMW. You get the distinct impression that they have no business with either one, and a crash is inevitable.

This is why we have long been proponents of term limits, which are hardly a new idea. The concept dates back to ancient Rome and Greece, with the great Greek philosopher Aristotle observing, “It is not so easy to do wrong in a short as in a long tenure of office.”

This idea was most famously summed up many years later by English historian, politician and author Lord Acton, who said, “Power tends to corrupt, and absolute power corrupts absolutely. Great men are almost always bad men.” The current DC bureaucracy seems to be trying their best to become a living illustration that absolute power corrupts absolutely and turns you into a bad person.

In 1807, halfway through his own second term, President Thomas Jefferson warned that "if some termination to the services of the chief Magistrate be not fixed by the Constitution, or supplied by practice, his office, nominally four years, will in fact become for life." He was quite prescient: in Congress, even dying of old age doesn’t keep some incumbents from getting reelected.

The popular novelist James Fenimore Cooper summed up the prevailing American attitude in 1838 when he said that "contact with the affairs of state is one of the most corrupting of the influences to which men are exposed." This might explain why so many of them mysteriously retire (if they ever do retire) as multi-millionaires after a life selflessly devoted to moderately-paid “public service.”

Historian Robert Struble notes that the American preference for turnover in leadership was so deeply ingrained that it took until the twentieth century for the concept of “career politicians” to take hold. Unfortunately, among the many bad ideas that arose in the twentieth century, like Nazism, socialism, and letting movie actors talk, came the argument that a lifetime of "experience" in government was a far more valuable asset than a fresh perspective or a knowledge of business, farming, energy or other fields in which the vast majority of Americans work (and that the government oversees.) Not everyone swallowed that argument, including twentieth-century Presidents of both parties.

In 1953, after deciding not to run for a third term, Democrat President Harry Truman said:

“In my opinion, eight years as President is enough and sometimes too much for any man to serve in that capacity. There is a lure in power. It can get into a man's blood just as gambling and lust for money have been known to do.”

Interesting quote, considering that he became President only because he was Franklin Roosevelt's Vice President when FDR died in office shortly after being reelected to his fourth term. This is what inspired the 22nd Amendment, limiting Presidents to two terms.

Republican Calvin Coolidge, who was President in the 1920s, must’ve foreseen the rise of the worship of “charismatic” Democrats like Bill Clinton and Barack Obama when he said:

“When a man begins to feel that he is the only one who can lead in this republic, he is guilty of treason to the spirit of our institutions...It is difficult for men in high office to avoid the malady of self-delusion. They are always surrounded by worshipers. They are constantly, and for the most part sincerely, assured of their greatness. They live in an artificial atmosphere of adulation and exaltation which sooner or later impairs their judgment. They are in grave danger of becoming careless and arrogant.”

Old “Silent Cal” must have been truly passionate about this subject because we believe those are the most words he ever said in one sitting.

Re: Fair Tax and Term Limits

Good morning, Ambassador,

I have long been a proponent of the fair tax. A straight 10% would have discouraged illegals because the “under table” money they were sending back to their home country would not have happened. It would also have reimbursed a few of the benefits they were getting like healthcare, food stamps, and phones. Please don’t try to convince me they weren’t because I work in the healthcare field and this was happening in Obama’s time. We had proof!

On the term limits, I would love to see this go to a national ballot vote! Instead of our elected officials being able to decide, I would love for there to be a “We The People” vote without their input. I know that’s not the way our system works but it is time for this!

Regarding the rogue judiciary and far-left legislators, God will have the final say. It was prophesied in Isaiah 10:1 -- "What sorrow awaits the unjust judges and those who issue unfair laws." (New Living Translation)